Investment and Business Update

In our efforts to keep you up-to-date in such a rapidly changing environment, we provide the following summary to assist your understanding of events affecting our community, the global economy and share markets.

Key takeaways:

- We are now working remotely but remain available on the phone or via email. Our office locations are closed.

- Scheduled meetings and enquiries can be still be made and will be conducted over the phone or video conference.

- It is increasingly apparent this health pandemic will significantly impact lives and the global economy.

- Governments and Central banks are taking extreme measures to prevent the spread and support society and the economy. This bodes well for the share markets ability to rebound.

- So long as uncertainty remains, share markets will be volatile with large drops and rises occurring on a daily basis.

- Consecutive days of positive returns are promising, but there are unique elements to the current market environment that make any prediction of the duration or severity of the market correction uniquely challenging.

- As much as it is a cliché, remaining diversified is the key to weathering the volatility.

- On the back of unprecedented stimulus measures and declining new infection rates overseas there is optimism share markets will bounce.

- The faster we stop the virus, the quicker and stronger the economic recovery will be. We have a collective responsibility to ensure this.

Share market update

Too Fast, Too Furious

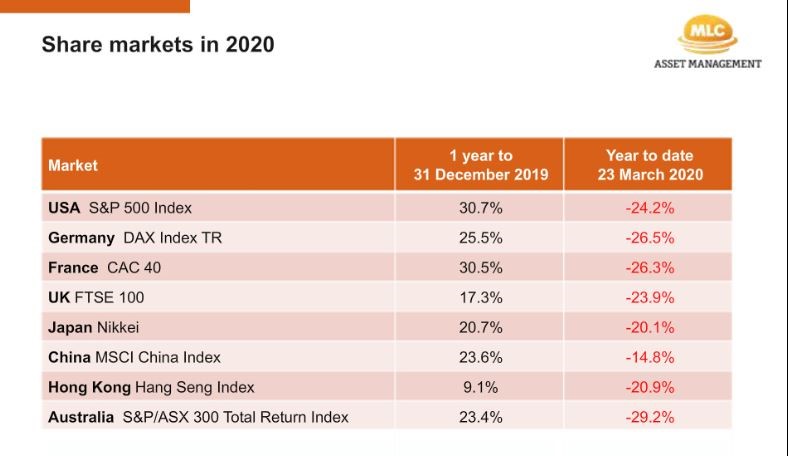

Share markets around the world have effectively given back the positive gains posted in 2019 as highlighted below:

The decline in share markets has been the fastest on record. In part, this is due to its unusual, unexpected and underestimated nature of the catalyst (a health pandemic). Further exacerbating the decline has been the elevated starting point of the market as well as the collapse in the oil price.

We expect share markets to remain volatile as transparency around the outlook remains uncertain and weak economic data filters through.

Faster and Faster

Whilst the size of the market decline is consistent with historical observations, the accelerated timeframe of the drawdown has been unique. There is a general belief that advancements in technology and the ready access and flow of market information has enabled faster trading patterns.

Furthermore, reactions to the release of sensationalised information tends to exaggerate market movements, both positive and negative.

These changes to the investment landscape have contributed to the trend of shorter time periods for a market downturn and subsequent recovery.

Challenges for investors

Simply put, faster market movements mean a faster response is required to enact market timing strategies. As the magnitude of market moves increases and the pace of the market picks up, market timing becomes an even more arduous strategy to enact. It is unrealistically difficult to time the market successfully.

As the size of daily market returns becomes more prominent, the probability of missing out on large and short-term market recoveries increases.

How do we respond to these challenges?

These large and fast market movements can be highly daunting and send even the most seasoned investors on an emotional roller coaster. These short-term bouts further emphasise our belief to remain invested rather than attempt to engage in risky market timing strategies.

We expect this approach to optimise long term risk-adjusted returns, especially as the speed of market movements rapidly increases.

Share market volatility and investor anxiety is likely to remain high until there is evidence that the number of new infections is falling or there is a definitive timeline for the delivery of an effective vaccine.

As much as it is a cliché, remaining diversified remains the key to weathering the volatility.

Economic update

As confronting as it might sound, it is now clear that we – like most countries – are likely to enter a recession. It has taken a few weeks for this to become obvious, mainly because it’s taken the world’s medical experts and Governments until now to make clear the need to take drastic action to the fight the virus by effectively closing down economic and community activity. The political narrative has shifted over the past week with the end goal now to ensure that those business closures don’t become permanent and that the population have jobs to return to when the crisis abates.

Of course, never-before-seen stimulus measures by Governments and Central banks are doing what they can to offset the loss of wages and profits that will arise from shutting down economic activity but they can only partly insulate the economy from a slowdown. The faster the virus stops, the quicker and stronger the recovery will be.

Where to from here

As no member of our Investment Committee possesses either a Medical or Scientific degree we can only speculate about how long it might take to develop an effective vaccine. However, in terms of containment, we have seen encouraging anecdotal evidence from countries that undertook early lock down measures such as Korea, Singapore and China, that infection rates are now falling and people are returning to work. Not surprisingly these successes seem to have been directly commensurate with the vigilance with which self-isolation and sanitation were applied in those countries. This message has not been lost on our Government that is now applying stronger measures to ensure we stay at home and limit the spread.

This gives us optimism that at some point in the near to medium term this problem will recede and a share market recovery will occur. These factors, coupled with the with colossal level of economic stimulus applied by Government and Central Banks provides a level of comfort that ‘this too shall pass’.

While we do not know when a volatility will subside, we do have confidence our portfolios are well positioned to capture the full upside of the eventual market recovery.

Thank you for keeping us informed it is a worrying times

Thank you for keeping us informed and please continue to do so

Thank you muirfield for your thorough explanation of the present investment situations. You always give a clear& sound explanation to us retirees & other investors.Thank you to all staff.