Investment Market Update

2024 Financial Year Wrap Up

The financial year ended 30 June 2024 was a positive one for Australian investors, however, the same cannot be said for mortgage holders. Whilst early in the financial year there was talk of potential interest rate reductions, persistent inflation and a mostly strong economy have meant the RBA cash rate has remained consistent at 4.35% since 7 November 2023. Economists are now predicting the RBA rate to stay at elevated levels for the rest of the 2024.

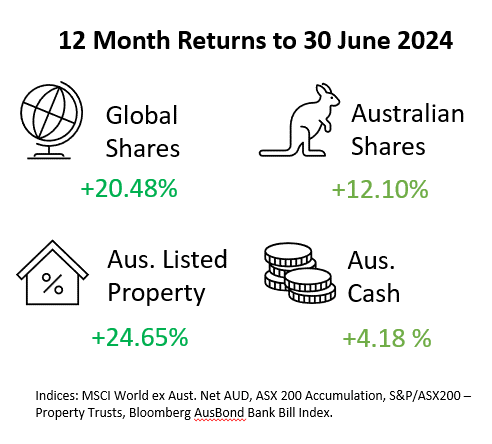

As shown in the infographic below all major investment sectors had a positive 12 months to 30 June, with the standout being Australian Listed Property with a 12 month return of 24.65%. This was closely followed by Global Shares at 20.48%.

For the financial year Australian equities rose 12.1% with the bank sector rising 29%, consumer discretionary 22% and IT 28% while consumer staples, materials and energy were in the red.

This is a reversal of the previous 12 months where the best performers were in energy and materials. This further justifies our belief that picking winners is a difficult proposition and as such a well-diversified portfolio is often the best way to avoid large falls in portfolio values.

The majority of the returns for the Australian Sharemarket were achieved between November and the end of April with the rest of the financial year being relatively flat overall.

For the next 6-12 months our expectations are anchored to inflation numbers and interest rates.

And you might be asking yourself, how does inflation and interest rates impact my investments and Superannuation? We published an article on the matter in our last edition of the eNews. To save you searching through the archives, a link can be found here.

In summary, when interest rates fall, borrowing becomes cheaper, stimulating investment as businesses and individuals are more willing to borrow to finance projects or purchases. Lower interest rates can boost economic activity, leading to increased corporate profits and potentially driving share and property prices higher. Both bode well for your investments.