What Is An Anti Detriment Benefit?

A recent Anti Detriment benefit provided a client with an additional $45,000 from her late husband’s Navigator Portfolio in addition to his account balance, providing her some financial comfort during this difficult time.

Anti Detriment benefits are not new, however the majority of superannuation funds continue to ignore this important estate planning feature available to their members. Anti Detriment is a refund of all tax on contributions paid by a member during the period of their superannuation. This also includes previous super history if your fund has been rolled over to Navigator.

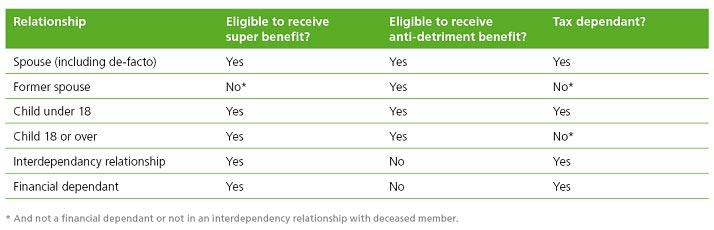

The following table summarises beneficiaries for the purposes of superannuation, tax dependency and anti detriment benefits.

The Anti Detriment benefit will be paid only if the super proceeds are taken as a lump sum. There may be situations where this is not appropriate and the continuation of a pension account for example may remain in place. There can also be tax issues if an adult child is to receive the benefit, which would be calculated at the time of inheritance.

With Muirfield Financial Services as your adviser we can determine the best financial outcome for you, including any impact on your Centrelink entitlements. If someone you know has superannuation not invested via Muirfield Financial Services perhaps they would benefit from your referral to us for information about this or other financial planning matters appropriate to their situation. Contact us to discuss this today.